tax break refund date

Show me when Ill receive my refund. At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.

Tax Refund Schedule 2022 Chart Mar Detailed Updates

3 or 4 days after e-filing a tax year 2020 or 2019 return.

. A tax credit reduces how much you need to pay in taxes or may even provide a refund. 2 For example if you owed 10000 in taxes a 3000 tax credit would lower what you owe to 7000. How to avoid tax on up to 10200 of unemployment benefits.

Learn How Long It Could Take Your 2021 Tax Refund. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer. 1 Return Received 2 Refund Approved and 3 Refund Sent.

The tax break is for those who earned less than 150000 in. Ad See How Long It Could Take Your 2021 Tax Refund. The 19 trillion coronavirus.

Check For The Latest Updates And Resources Throughout The Tax Season. Heres how much you could get. 2021 TAX RETURN.

Adjusted gross income and for unemployment insurance received during 2020. 22 2022 Published 742 am. Kemp signs bill to give Georgia taxpayers refunds.

Will Wheres My Refund. You can qualify for a tax credit even if you dont owe any taxes. When it went into effect on March 11 2021 the American Rescue Plan Act gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

Maximize your deductions and get every. Not the amount of. Using the IRS Wheres My Refund tool.

Heres what you need to know More. Blake Burman on unemployment fraud. This caused millions of taxpayers to file tax returns paying the taxes due by that date.

For 2021 if you earn up to 125000 you can claim 50 of qualified expenses. 6 months or more after filing a paper return. You will get personalized refund information based on.

The IRS will begin in May to send tax refunds in two waves to those who benefited from the 10200 unemployment tax break for claims in 2020. The 10200 is the amount of income exclusion for single filers not the amount of the refund. You can use the IRS Wheres My Refund.

Viewing your IRS account information. The 10200 tax break is the amount of income exclusion for single filers. Call the IRS at 800-829-1954.

House Bill 1302 which Kemp signed into law March 23 will give a refund of up to 250 to single filers up to 375 to single adults who head a household with dependents and up to 500 to married couples filing jointly. Online Account allows you to securely access more information about your individual account. If you filed on paper it could take 6 months or more.

You had to qualify for the exclusion with a modified adjusted gross income of less than 150000. 4 weeks after you mailed your return. Refund for unemployment tax break.

Will give you a personalized date after we process your return and approve your refund. Also the amount gradually decreases from 50 to 20 for income above 125000 to 400000 and ultimately phases out. By Anuradha Garg.

3 or 4 days after e-filing a tax year 2019 or 2020 return. Starting in May and into summer the IRS will begin to send tax refunds to those who benefited from the. MoreIRS tax refunds to start in May for 10200 unemployment tax break.

Check My Refund Status. How will unemployment tax break refund be sent in two phases by the IRS. Tax credits reduce your final tax bill on a dollar-for-dollar basis.

Will display the status of your refund usually on the most recent tax year refund we have on file for you. 24 hours after e-filing a tax year 2021 return. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next.

Brian Kemp signs a bill to give state income refunds of more than 11 billion on Wednesday March 23 2022 at the Georgia capitol in Atlanta. May 12 2022 917 AM. Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software.

24 hours after e-filing a tax year 2021 return. Americans who collected unemployment benefits last year could soon receive a tax refund from the IRS on up to 10200 in aid. 24 hours after e-filing.

The measure gives refunds of 250 to 500 to people who filed tax returns for 2020 and 2021. Has a tracker that displays progress through 3 stages. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

Although some states add state taxes to the benefits Minnesota issued a tax exemption just as the federal government did. Unemployment Income Rules For Tax Year 2021.

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

When To Expect Your 2022 Irs Income Tax Refund

Here S How Long It Will Take To Get Your Tax Refund In 2022 Cbs News

Tax Refund Timeline Here S When To Expect Yours

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Tax Refund Deadline 2022 What Should You Know Before April 18 Marca

Tax Refund Stimulus Help Facebook

If As Of Date On Transcript Is Based On Something The Irs Did In The Past Why Do I Have An As Of Date That S In The Future 3 15 2021 R Irs

United States Is My Tax Return Refund Unsually Late Personal Finance Money Stack Exchange

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Child Tax Credit 2022 When Is The Irs Releasing Refunds With Ctc Marca

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

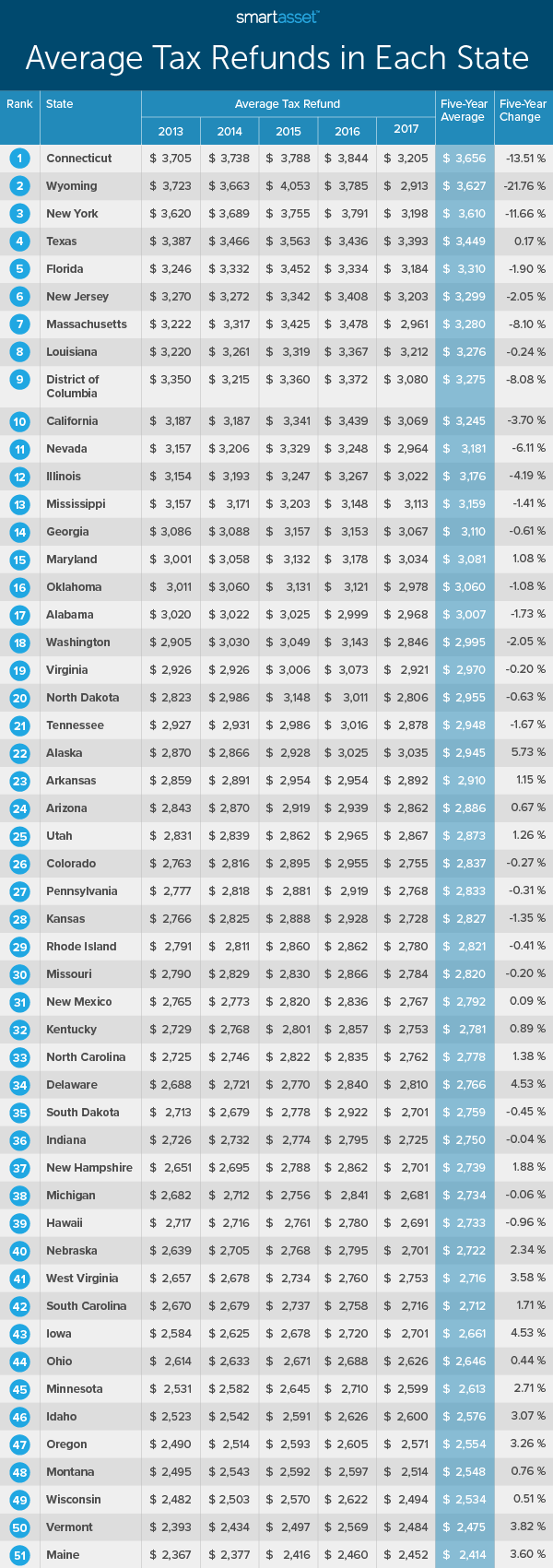

Tax Refunds In America And Their Hidden Cost 2020 Edition

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

When Will I Receive My Tax Refund Will It Be Delayed Forbes Advisor

Tax Refunds In America And Their Hidden Cost 2020 Edition

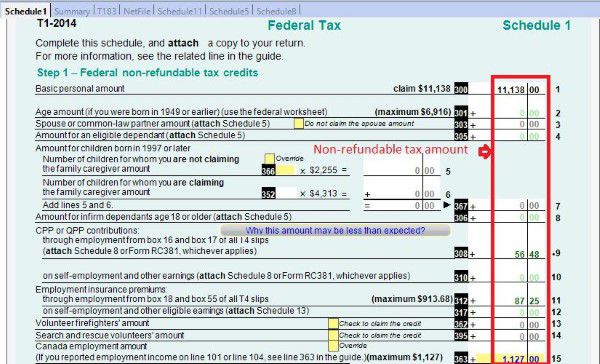

Tax Course 8 Understand Individual Income Tax Return